Introduction to Forex & CFD Trading

Leading the Way in Fintech Solutions

What is Forex Trading?

Forex trading, or foreign exchange trading, involves buying and selling currencies on the foreign exchange market with the aim of making a profit. The Forex market is the largest and most liquid financial market in the world, with a daily trading volume exceeding $6 trillion.

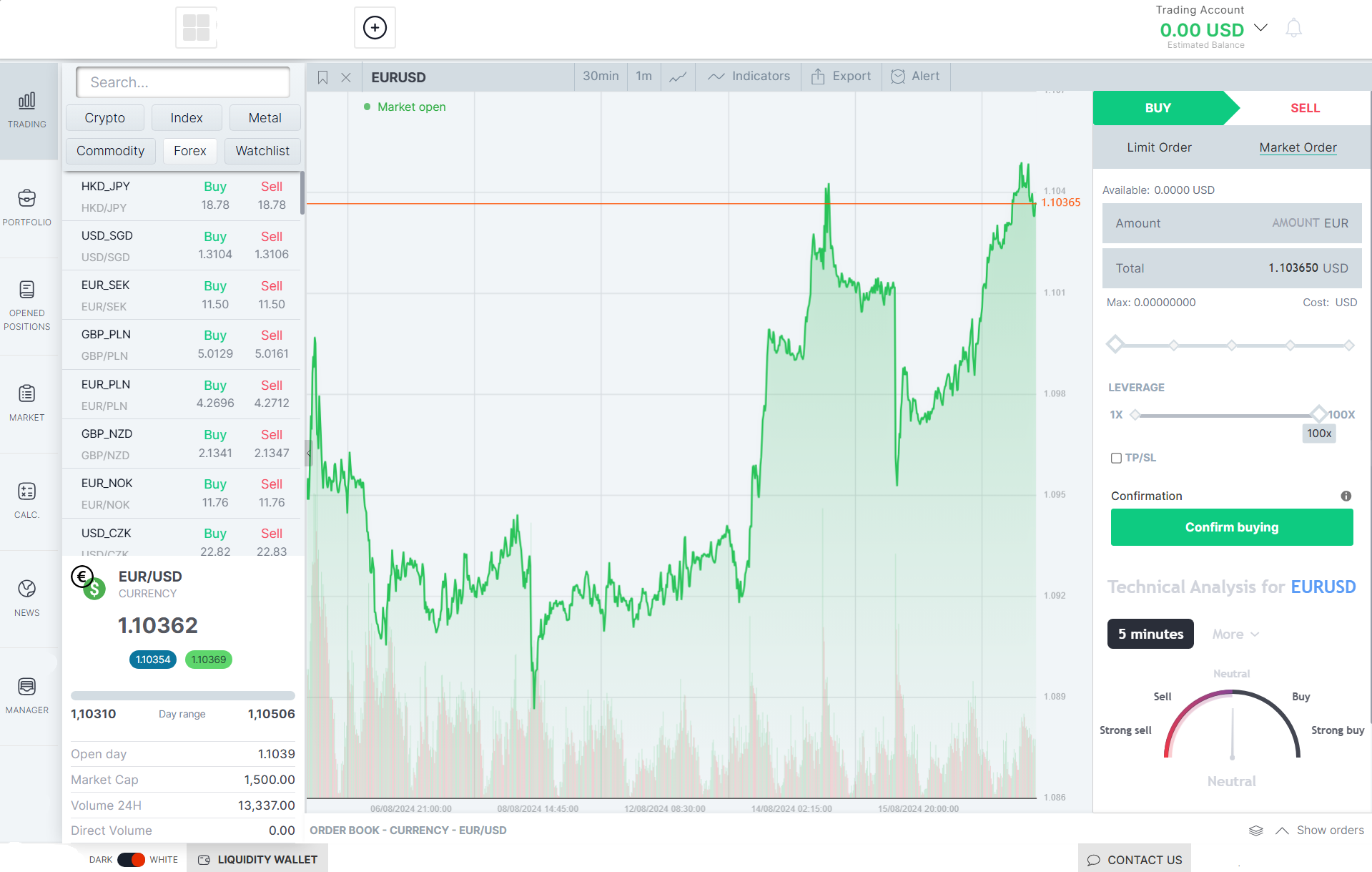

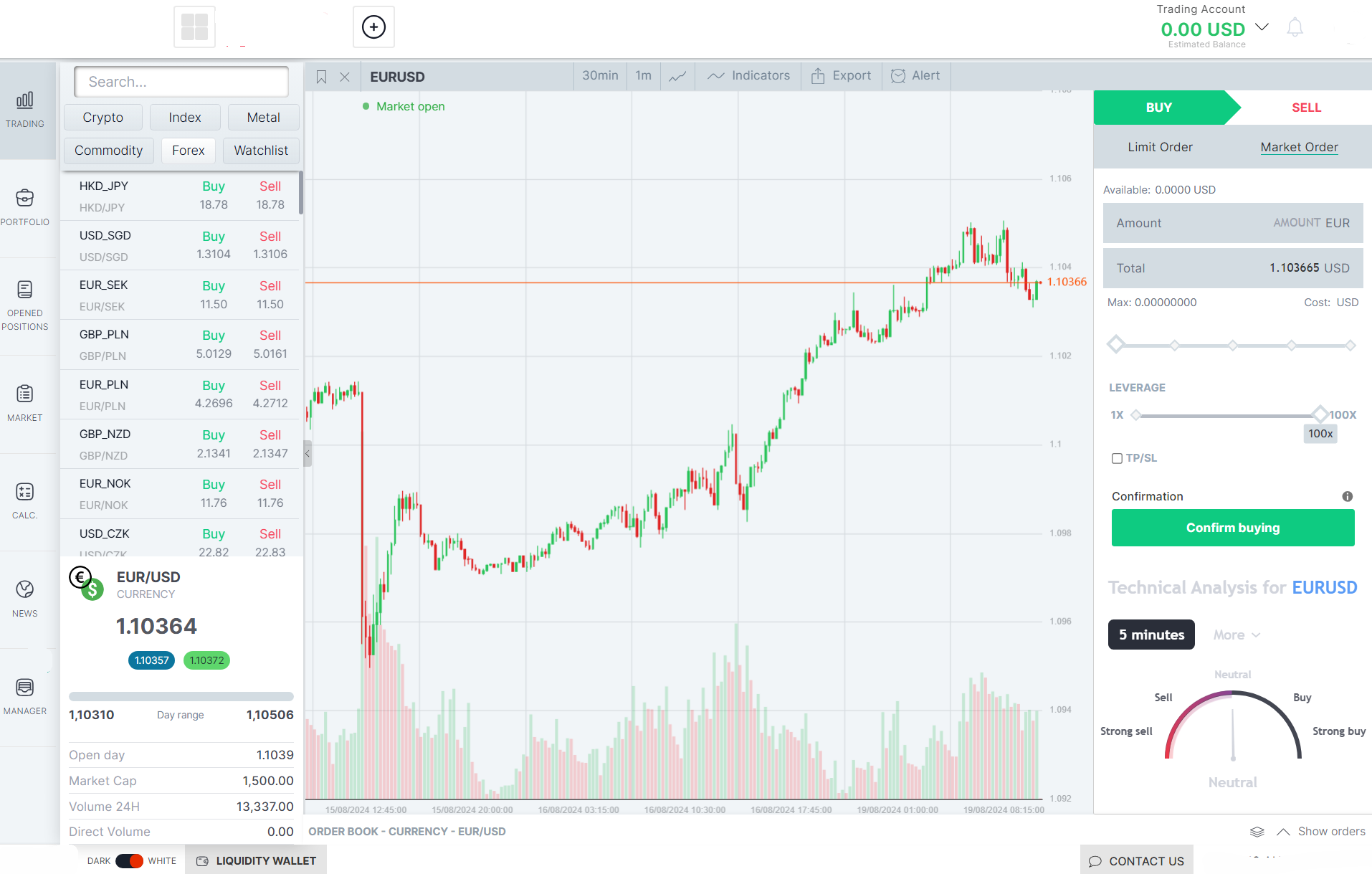

Currencies are traded in pairs, such as EUR/USD (Euro/US Dollar), and the price of each currency pair fluctuates based on supply and demand factors, including economic indicators, geopolitical events, and market sentiment. Traders aim to profit from these fluctuations by buying low and selling high, or vice versa.

What is CFD Trading?

CFD stands for Contract for Difference. CFD trading allows traders to speculate on the price movements of various financial instruments, such as stocks, commodities, indices, and cryptocurrencies, without owning the underlying asset.

When trading CFDs, you enter into a contract with a broker to exchange the difference in the price of an asset from the time the contract is opened to the time it is closed. This means you can profit from both rising and falling markets, making CFDs a versatile trading option.

Benefits of Forex and CFD Trading

High Liquidity

Leverage

Flexibility

Diverse Opportunities

Key Terminology

- Pips: The smallest price movement in a currency pair. For most currency pairs, a pip is equal to 0.0001.

- Lots: Standardized quantities of currency or assets in trading. In Forex, a standard lot is 100,000 units of the base currency.

- Leverage: The use of borrowed funds to increase the potential return on investment. Leverage is expressed as a ratio, such as 1:100.

- Margin: The amount of capital required to open and maintain a leveraged position. Margin is usually expressed as a percentage of the full position size.

- Spread: The difference between the bid (buy) price and the ask (sell) price of a currency pair or CFD.

Common Questions About Forex & CFD Trading

Forex trading involves the buying and selling of currencies in pairs, such as EUR/USD, while CFD (Contract for Difference) trading allows traders to speculate on the price movements of various financial instruments, including stocks, commodities, indices, and cryptocurrencies, without owning the underlying asset. Forex trading focuses solely on currency pairs, whereas CFDs offer a broader range of trading opportunities.

The required capital depends on the trading strategy and the broker's requirements. For Forex trading, you can start with as little as $100, but $500-$1000 is often recommended to provide a buffer against losses and to make meaningful trades. CFD trading might require more capital depending on the assets traded. Always ensure you're using money you can afford to lose.

Leverage allows you to control a larger position with a smaller amount of capital. For example, with 1:100 leverage, you can control $10,000 with just $100. While leverage can amplify profits, it also increases the potential for losses. It's crucial to use leverage wisely and understand the risks involved.

The choice of indicators depends on your trading style and strategy. For example, scalpers might use moving averages and Bollinger Bands for quick decision-making. Day traders often use Fibonacci retracements and volume indicators. SwTrdixrs might rely on trend lines and MACD. Position traders focus on fundamental analysis with support from long-term technical indicators. Experiment with different indicators in a demo account to see which ones complement your strategy.

Backtesting is crucial as it allows you to test your strategy on historical data to see how it would have performed. This helps identify any weaknesses and areas for improvement. However, keep in mind that past performance does not guarantee future results. It’s an important step to refine your strategy before using it in a live trading environment.

Yes, automated trading systems, or trading bots, can be used to implement various strategies, especially for scalping and day trading. These systems can execute trades based on predefined criteria without human intervention, which can be beneficial for executTrdixs quickly and efficiently. However, it's important to monitor automated systems regularly to ensure they are functioning as expected.

Forex trading strategies typically focus on currency pairs and are influenced by economic indicators and geopolitical events. CFD trading strategies can be applied to a broader range of assets, including stocks, commodities, and indices, and might involve different techniques like hedging and arbitrage. The choice of strategy depends on the specific market conditions and the trader's objectives.

Risk management is essential in trading. Key techniques include setting stop-loss orders to limit potential losses, using take-profit orders to lock in gains, proper position sizing to avoid overexposure to any single trade, diversification to spread risk across different trades or assets, and maintaining a trading journal to track performance and identify areas for improvement.

Risk management is essential in trading. Key techniques include setting stop-loss orders to limit potential losses, using take-profit orders to lock in gains, proper position sizing to avoid overexposure to any single trade, diversification to spread risk across different trades or assets, and maintaining a trading journal to track performance and identify areas for improvement.