Market Analysis

Market analysis is a fundamental aspect of trading, providing the necessary insights to make informed decisions. It involves studying various factors that influence market prices, such as economic indicators, historical price data, and market sentiment. A comprehensive approach to market analysis can significantly enhance your trading performance by helping you anticipate market movements and identify trading opportunities.

Fundamental Analysis

Economic Indicators:

These are statistical data points that provide insights into a country’s economic performance and health. Common economic indicators include Gross Domestic Product (GDP), unemployment rates, inflation rates, and industrial production. Traders analyze these indicators to gauge the economic strength of a country and its currency.

- GDP: Measures the total economic output of a country. A growing GDP indicates a strong economy, which can lead to a stronger currency.

- Inflation Rates: High inflation can erode purchasing power, leading central banks to adjust interest rates, which in turn affects currency value.

- Employment Data: High employment rates generally signal economic growth, leading to stronger currency performance.

Central Bank Policies:

Central banks play a pivotal role in shaping economic conditions through monetary policy. Key actions include setting interest rates, conducting open market operations, and implementing quantitative easing or tightening measures. Traders closely monitor central bank announcements and meeting minutes for hints about future policy changes.

- Interest Rate Decisions: Higher interest rates can attract foreign investment, boosting the currency value.

- Quantitative Easing: Involves increasing the money supply to stimulate the economy, which can depreciate the currency.

Geopolitical Events:

Political stability, government policies, trade negotiations, and conflicts significantly impact market conditions. For example, trade wars, elections, and regulatory changes can lead to market volatility.

- Elections: Political uncertainty before elections can lead to market volatility. Post-election, new policies can drive market trends.

- Trade Wars: Tariffs and trade barriers affect global trade dynamics and market sentiment.

Corporate Earnings:

For stock and index traders, analyzing corporate earnings reports, revenue growth, and profitability metrics provides insights into a company’s performance and future prospects.

- Earnings Reports: Quarterly and annual reports that detail a company's financial performance.

- Revenue Growth: Indicates the company's ability to increase sales and expand market share.

Example: If the European Central Bank (ECB) signals an intention to increase interest rates due to rising inflation, the Euro may appreciate against other currencies as investors seek higher returns on Euro-denominated assets. Traders might buy EUR/USD in anticipation of this appreciation.

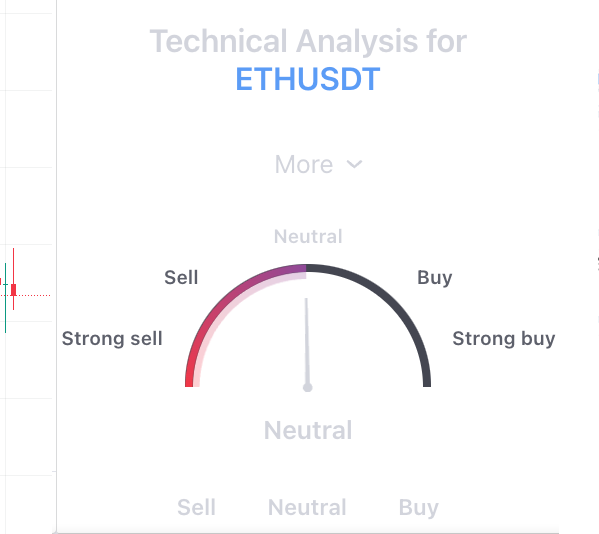

Technical Analysis

Technical analysis focuses on studying past price movements and trading volumes to predict future price movements. This type of analysis is based on the premise that historical price data can provide insights into future price behavior.

Chart Types and Indicators

Various chart types, such as candlestick, bar, and line charts, are used to visualize price movements over different timeframes. Candlestick charts are particularly popular due to the detailed information they provide about price action, showing the open, high, low, and close prices.

Moving averages smooth out price data to identify trends over a specific period. The Simple Moving Average (SMA) calculates the average price over a set number of periods, while the Exponential Moving Average (EMA) gives more weight to recent prices.

The Relative Strength Index (RSI) is an oscillator that measures the speed and change of price movements, indicating overbought or oversold conditions. RSI values above 70 suggest a potential price correction or reversal, while values below 30 indicate a potential price rebound.

Bollinger Bands are volatility bands placed above and below a moving average. These bands widen during periods of high volatility and contract during low volatility, indicating potential overbought or oversold conditions.

Support and Resistance Levels

Support and resistance levels are horizontal lines on a chart indicating where the price has historically had difficulty moving above (resistance) or below (support). These levels are critical for identifying entry and exit points. A support level is a price level where buying interest is strong enough to prevent the price from falling further, while a resistance level is where selling interest is strong enough to prevent the price from rising further.

Example: A trader might use moving averages to identify a bullish trend in a currency pair. If the 50-day SMA crosses above the 200-day SMA (a bullish signal known as the “Golden Cross”), the trader might enter a long position expecting further upward movement.

Sentiment Analysis

Market Sentiment Indicators

Central Bank Policies:

Volume Analysis

Combining Different Types of Analysis

This integrated approach helps traders mitigate risks and improve the accuracy of their trades.

- Fundamental analysis identifies strong economic indicators for a currency, such as a growing GDP and a potential interest rate hike.

- Technical analysis confirms the uptrend with moving averages and support levels, such as the 50-day SMA crossing above the 200-day SMA.

- Sentiment analysis checks for positive sentiment in news and social media, such as optimistic reports from major financial news outlets and bullish sentiment on social media platforms.

Continuous Learning and Adaptation

Market analysis is an ongoing process. As markets evolve, so too must your analytical techniques. Staying updated with new tools, indicators, and methodologies is essential to refining your approach and enhancing your trading performance. By mastering market analysis, traders can gain a deeper understanding of market dynamics, improve their decision-making, and ultimately achieve greater success in their trading endeavors.

Educational Resources

Practice

Feedback and Review

Common Questions About Risk Management

Fundamental analysis evaluates economic, financial, and other qualitative and quantitative factors that influence an asset's intrinsic value, such as economic indicators, central bank policies, geopolitical events, and corporate earnings. It is used to understand the underlying reasons behind market movements and make long-term investment decisions. Technical analysis, on the other hand, focuses on studying past price movements and trading volumes to predict future price movements. It uses tools like charts, moving averages, RSI, and Bollinger Bands to identify trends and potential entry and exit points.

Economic indicators provide insights into a country's economic performance and health. For example, a growing GDP indicates a strong economy, which can lead to a stronger currency. High inflation rates can prompt central banks to adjust interest rates, affecting currency values. Employment data are also crucial; high employment rates generally signal economic growth, leading to stronger currency performance. Traders use these indicators to anticipate market movements and make informed trading decisions.

Support and resistance levels are horizontal lines on a chart indicating where the price has historically had difficulty moving above (resistance) or below (support). These levels are critical for identifying entry and exit points. A support level is a price level where buying interest is strong enough to prevent the price from falling further, while a resistance level is where selling interest is strong enough to prevent the price from rising further. These levels help traders predict potential price movements and make more informed trading decisions.

Sentiment analysis involves gauging the overall mood of market participants to predict potential price movements. It uses data from various sources, including news articles, social media, and trading volumes. For example, the Commitment of Traders (COT) report provides a snapshot of market positions held by different types of traders. News and social media platforms like Twitter and Reddit can influence market trends through collective sentiment. Volume analysis also helps understand the strength of a price movement. High volume on a price increase often indicates strong bullish sentiment, while high volume on a price decrease indicates strong bearish sentiment.

Yes, combining different types of analysis can provide a more comprehensive view of the market. By integrating fundamental, technical, and sentiment analysis, traders can confirm signals and make more confident trading decisions. For example, fundamental analysis might identify strong economic indicators for a currency, technical analysis can confirm an uptrend with moving averages, and sentiment analysis can check for positive sentiment in news and social media. This integrated approach helps mitigate risks and improve the accuracy of trades.

Market analysis is an ongoing process. As markets evolve, so too must your analytical techniques. Regularly reviewing and updating your market analysis methods is essential to stay ahead of market trends. Continuous learning through educational resources such as books, online courses, webinars, and tutorials is crucial. Using demo accounts to practice and refine your strategies without risking real money is also important. Regularly reviewing your trades and maintaining a trading journal to document your strategies and outcomes helps identify strengths and areas for improvement.

Numerous tools and resources are available for learning market analysis. Educational platforms like Coursera, Udemy, and Investopedia offer comprehensive courses covering various aspects of market analysis. Many brokers provide demo accounts for practicing different types of analysis in a risk-free environment. Books, online tutorials, and webinars also offer valuable insights into market analysis techniques. Additionally, maintaining a trading journal to document your trades, strategies, and outcomes is an effective way to track progress and refine your approach.

The Relative Strength Index (RSI) is an oscillator that measures the speed and change of price movements, indicating overbought or oversold conditions. RSI values above 70 suggest a potential price correction or reversal, while values below 30 indicate a potential price rebound. Traders use RSI to identify potential entry and exit points. For example, if the RSI indicates that a currency pair is overbought, a trader might consider selling or taking a short position.

Moving averages help smooth out price data to identify trends over a specific period. The Simple Moving Average (SMA) calculates the average price over a set number of periods, while the Exponential Moving Average (EMA) gives more weight to recent prices, making it more responsive to new information. Traders use moving averages to identify trend direction and potential reversal points. For example, if the 50-day SMA crosses above the 200-day SMA (a bullish signal known as the "Golden Cross"), it indicates a potential uptrend.

Applying market analysis techniques in a demo account allows you to practice and refine your strategies without risking real money. Many brokers offer demo accounts with real-time market data. You can use these accounts to test different types of analysis, such as fundamental, technical, and sentiment analysis. By experimenting with various tools and indicators, you can develop and fine-tune your trading strategies. Regularly review your demo account trades to identify strengths and areas for improvement, helping you prepare for live trading.