Trading Strategies Guide

In the dynamic world of Forex and CFD trading, having a well-defined strategy is crucial to achieving consistent success. A trading strategy serves as a roadmap, guiding your decisions and helping you navigate the complexities of the financial markets. This section will explore various trading strategies suitable for different trading styles and objectives. Whether you are a beginner looking to understand the basics or an experienced trader seeking to refine your approach, this guide provides valuable insights into developing and implementing effective trading strategies.

Why Trading Strategies are Important

- Consistency: A trading strategy provides a structured approach, helping you make consistent decisions based on predefined criteria rather than emotions.

- Risk Management: Strategies include risk management techniques to protect your capital and minimize losses.

- Performance Evaluation: With a clear strategy, you can track and evaluate your performance, identifying areas for improvement.

- Adaptability: A well-researched strategy can adapt to changing market conditions, keeping you ahead of the curve.

Key Components of a Trading Strategy

- Market Analysis: Understanding the market environment through fundamental, technical, and sentiment analysis.

- Trade Execution: Deciding when to enter and exit trades based on your analysis.

- Risk Management: Implementing measures to control potential losses, such as stop-loss orders and position sizing.

- Performance Monitoring: Continuously reviewing and refining your strategy to enhance its effectiveness.

Forex Trading Strategies

Scalping

- Time Frame: Typically 1-5 minute charts.

- Key Indicators: Moving Averages, Bollinger Bands, RSI.

- Example: A trader might enter a trade when the price crosses above a moving average and exit within a few minutes after a small price increase.

Day Trading

- Time Frame: 15-minute to hourly charts.

- Key Indicators: Fibonacci retracements, MACD, Volume indicators.

- Example: A trader may buy a currency pair in the morning, take advantage of a price increase during the day, and sell before the market closes.

Swing Trading

- Time Frame: Daily to weekly charts.

- Key Indicators: Trend lines, MACD, Stochastic Oscillator.

- Example: A trader identifies a currency pair in an uptrend, buys the pair, and holds the position for several days until the price reaches a significant resistance level.

Position Trading

- Time Frame: Weekly to monthly charts.

- Key Indicators: Economic data, geopolitical events, interest rate changes.

- Example: A trader buys a currency pair based on strong economic growth forecasts and holds the position for several months, benefiting from the currency's appreciation.

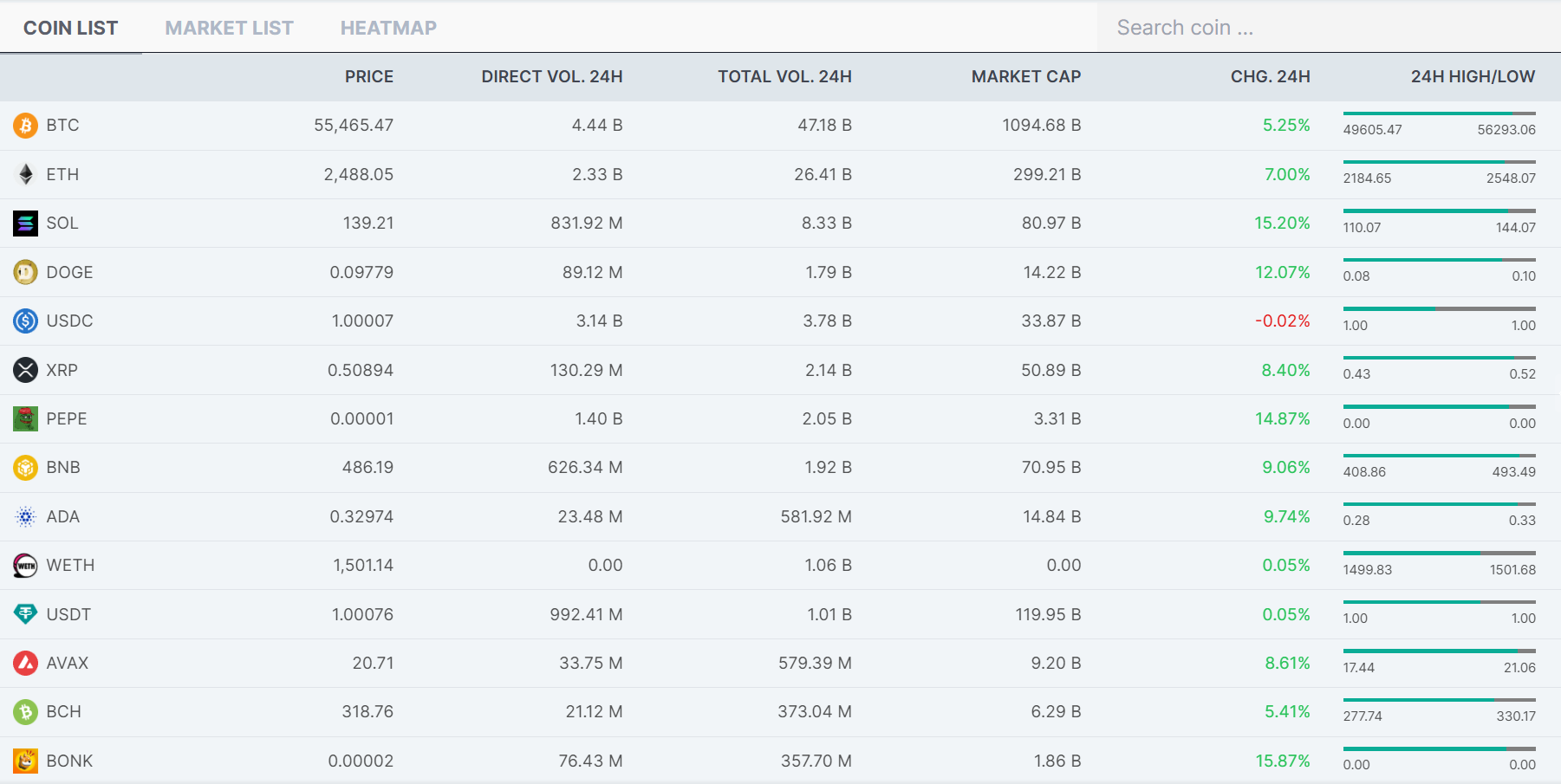

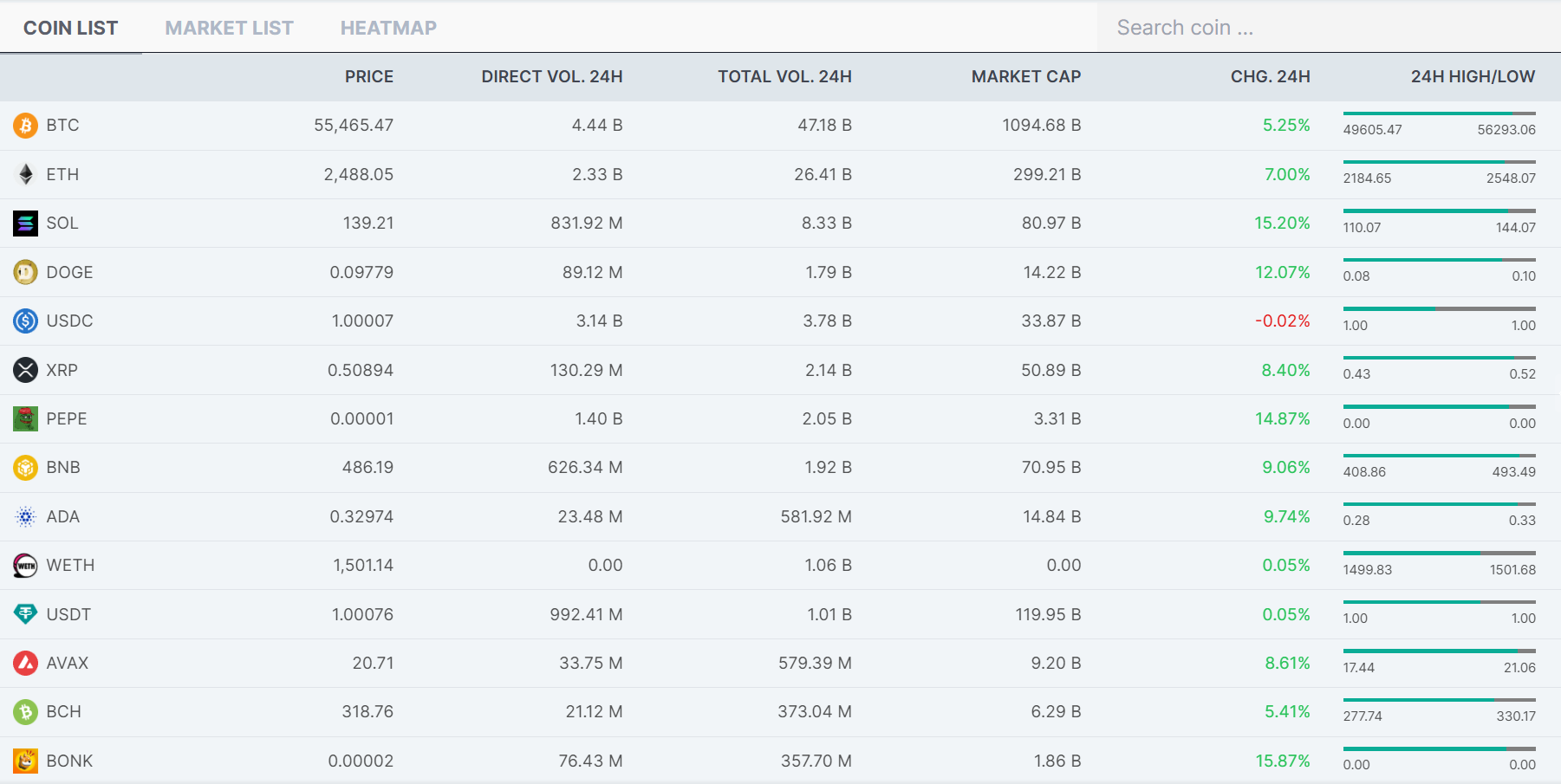

CFD Trading Strategies

Hedging

- Key Instruments: Related CFDs, options.

- Example: A trader holding a long position in a stock CFD may take a short position in a market index CFD to offset potential losses if the stock price drops.

Arbitrage

- Key Instruments: Different market CFDs.

- Example: A trader notices that a stock CFD is priced lower on one platform than on another. They buy the lower-priced CFD and sell the higher-priced CFD, profiting from the difference.

Speculative Trading

- Key Instruments: Various CFDs including commodities, indices, and cryptocurrencies.

- Example: A trader speculates that the price of gold will rise due to economic uncertainty. They buy gold CFDs and sell them after the price increases.

Leading the Way in Fintech Solutions

Setting Goals and Risk Tolerance

- What are your profit targets?

- How much are you willing to risk per trade?

- What is your overall risk tolerance?

Backtesting and Refining Your Strategy

- Tools: Trading platforms with backtesting capabilities, such as MetaTrader or TradingView.

- Process: Select a historical data set, apply your strategy, and analyze the results. Adjust your strategy based on findings and retest.

Implementing and Monitoring Your Strategy

- Tools: Trading journals, performance analytics tools.

- Tips: Keep detailed records of your trades, regularly review your performance, and stay updated with market news and trends.

Common Questions About Trading Strategies

For beginners, it is often recommended to start with day trading or swing trading. These strategies are less intensive than scalping and less complex than position trading. They offer a good balance between risk and reward, and the learning curve is manageable. It's important to start with a demo account to practice before trading with real money.

The required capital depends on the trading strategy and the broker's requirements. For Forex trading, you can start with as little as $100, but $500-$1000 is often recommended to provide a buffer against losses and to make meaningful trades. CFD trading might require more capital depending on the assets traded. Always ensure you're using money you can afford to lose.

Leverage allows you to control a larger position with a smaller amount of capital. For example, with 1:100 leverage, you can control $10,000 with just $100. While leverage can amplify profits, it also increases the potential for losses. It's crucial to use leverage wisely and understand the risks involved.

The choice of indicators depends on your trading style and strategy. For example, scalpers might use moving averages and Bollinger Bands for quick decision-making. Day traders often use Fibonacci retracements and volume indicators. SwTrdixrs might rely on trend lines and MACD. Position traders focus on fundamental analysis with support from long-term technical indicators. Experiment with different indicators in a demo account to see which ones complement your strategy.

Backtesting is crucial as it allows you to test your strategy on historical data to see how it would have performed. This helps identify any weaknesses and areas for improvement. However, keep in mind that past performance does not guarantee future results. It’s an important step to refine your strategy before using it in a live trading environment.

Yes, automated trading systems, or trading bots, can be used to implement various strategies, especially for scalping and day trading. These systems can execute trades based on predefined criteria without human intervention, which can be beneficial for executTrdixs quickly and efficiently. However, it's important to monitor automated systems regularly to ensure they are functioning as expected.

Forex trading strategies typically focus on currency pairs and are influenced by economic indicators and geopolitical events. CFD trading strategies can be applied to a broader range of assets, including stocks, commodities, and indices, and might involve different techniques like hedging and arbitrage. The choice of strategy depends on the specific market conditions and the trader's objectives.

Risk management is essential in trading. Key techniques include setting stop-loss orders to limit potential losses, using take-profit orders to lock in gains, proper position sizing to avoid overexposure to any single trade, diversification to spread risk across different trades or assets, and maintaining a trading journal to track performance and identify areas for improvement.

Discipline in trading involves sticking to your predefined trading plan and not letting emotions drive your decisions. Key tips include setting clear goals and limits for each trade, following a routine and avoiding impulsive trades, regularly reviewing and updating your strategy based on performance and market conditions, and taking breaks to avoid burnout and maintain a clear mind.

There are numerous resources available for learning more about trading strategies, including books, online courses, webinars, trading communities, and broker educational resources. Many comprehensive guides and textbooks on trading strategies are available. Online platforms like Udemy, Coursera, and specialized trading education sites offer courses. Live and recorded webinars by experienced traders and analysts provide valuable insights. Joining forums, social media groups, and local meetups where traders share knowledge and experiences can be very beneficial. Many brokers also offer tutorials, articles, and demo accounts for practice.